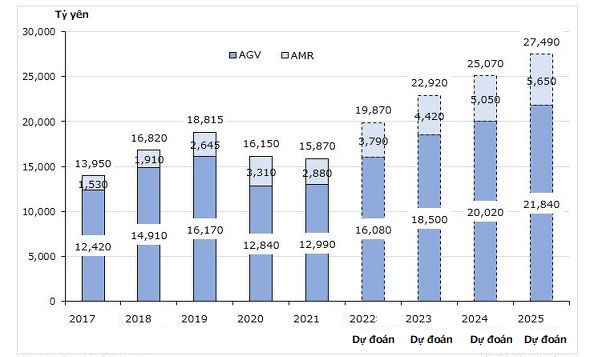

The domestic AGV/AMR market is expected to ship 10,000 units in 2025, with a scale of 30 billion yen

On August 17, 2022, Yano Research Institute announced the results of a survey on the domestic AGV (automated guided robot) / AMR (autonomous mobile robot) market. In fiscal year 2025 (ending March 2026), the number of units shipped is expected to grow to approximately 10,000 units, with a shipment value of approximately 30 billion yen.

Both shipment volume and value decreased for the second consecutive year

AGV/AMR market size (manufacturer shipment basis) is 7,055 units in FY2020 (down 6.7% year-on-year), 16.15 billion yen (down 14.2% year-on-year), and 6,400 units in FY2021 (down 9.3% year-on-year). , 15.87 billion yen (down 1.7% year on year), both the number of units shipped and the value of shipments decreased from the previous year for the second consecutive year.

In fiscal 2020, there was a positive effect from the introduction of new products by manufacturers, but due to the uncertainty of the economy due to the spread of the new coronavirus infection, there were many cases of temporary freezes on capital investment by user companies. decreased.

In FY2021, in addition to the prolonged corona disaster, product shipments were greatly restricted due to the shortage of semiconductors that occurred in the latter half of 2020, resulting in negative growth following the previous year.

Regarding semiconductor shortages, not only LiDAR (Light Detection and Ranging), which is used to detect obstacles, but also motors, batteries, connectors, etc. are conspicuous, and the impact is expected to continue at least until around the summer of 2023.

AGV/AMR Shipment Trends and Forecasts Source: Yano Research Institute

AGV/AMR Shipment Trends and Forecasts Source: Yano Research Institute

Expected to expand after FY2022

The AGV/AMR market size in FY2022 is expected to reach 7,700 units (up 20.3% year-on-year) and 19.87 billion yen (up 25.2% year-on-year). Although the impact of the shortage of semiconductors will continue, manufacturers are expected to improve and strengthen their supply systems during the previous fiscal year.

From FY 2023 onwards, the labor shortage and increased demand for capital investment will be positive factors, and in FY 2025, the shipment volume is expected to grow to 9,950 units and the shipment value to 27.49 billion yen.

However, user companies are becoming more cost-conscious due to soaring raw material prices, and new market entries and new product launches are expected to bring the market closer to saturation in the future. It is supposed to be a material.